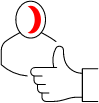

Expert Non-Profit CPA Tips: 10-Point Audit Checklist

Discover actionable tips and proven methods to streamline audit preparation and enhance financial efficiency in our comprehensive guide, backed by years of non-profit CPA expertise.

Unlock Audit Success With Expert Non-Profit CPA Insights

Explore the essential steps to prepare your non-profit for audits and ensure a smooth and efficient process.

What’s covered in the guide?

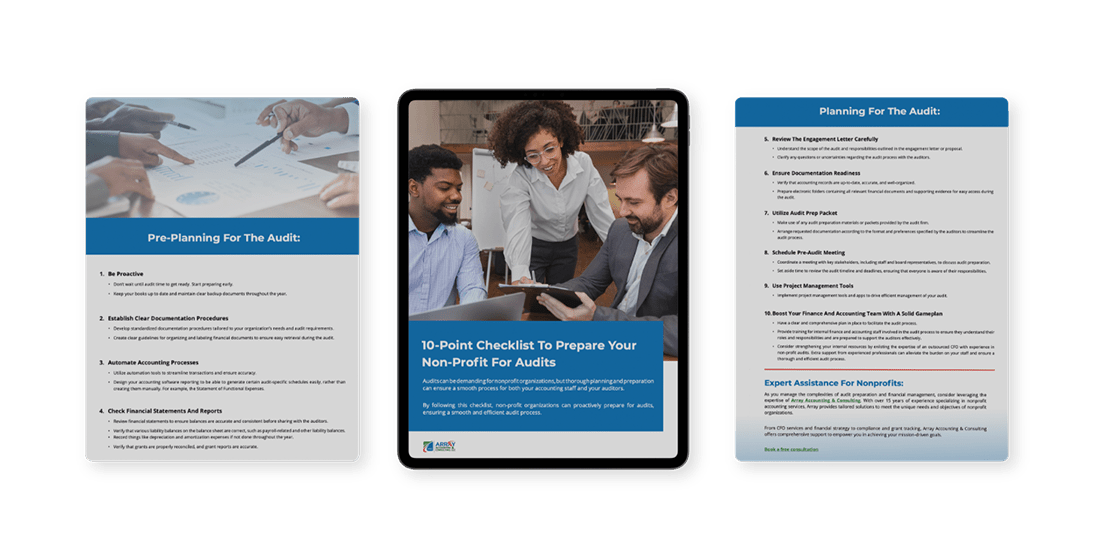

Proactive Pre-Planning

Streamlined Documentation

Automated Accounting Processes

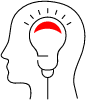

Detailed Audit Planning

Expert Assistance

Proactive Pre-Planning

Streamlined Documentation

Automated Accounting Processes

Detailed Audit Planning

Expert Assistance

Submit the form to receive your copy!

Get The Free Guide

Who Is This Guide For?

This checklist is specifically created for non-profit organizations aiming to optimize their audit preparation and financial management. This checklist is your comprehensive resource for navigating the complexities of a non-profit audit process.

Designed with CEOs, finance executives, and business professionals in mind, this guide offers valuable insights, actionable strategies, and practical tips tailored to the unique challenges of non-profit accounting.

How Will This Benefit Me?

Tailored for non-profit CEOs, finance executives, and business professionals, this checklist offers essential guidance to navigate a financial audit seamlessly. With the expertise of a non-profit CPA, you can expect the following benefits:

Thorough Audit Preparation

Gain invaluable insights tailored to non-profit organizations. Access actionable tips for enhanced preparation and streamlined operations, fostering financial transparency and accountability.

Efficiency Enhanced

Optimize your audit preparation with proven techniques and clear guidelines. Streamline accounting processes, ensuring accuracy and compliance without sacrificing efficiency.

Empower Your Finance Team

Equip your team with the tools and knowledge needed to navigate the audit seamlessly. Gain valuable insights and practical tips tailored to non-profit organizations, ensuring a thorough and efficient audit process.

Who Put This Non-Profit Audit Checklist Together?

The non-profit audit preparation checklist was written by Danielle Wright, who leads Array Accounting & Consulting.

Danielle is a highly experienced non-profit CPA with over 15 years of diverse financial expertise. Having worked extensively in audit, consulting, and financial leadership roles, Danielle understands the unique challenges and requirements of non-profit organizations.

Her dedication to excellence, strategic insights, and commitment to empowering non-profits make this checklist an indispensable tool for navigating the complexities of a financial audit with confidence.

FAQs

Audit preparation ensures that non-profit organizations have accurate financial records, comply with regulatory standards, and demonstrate financial transparency to stakeholders, including donors and grantors.

Our checklist provides comprehensive guidance on maintaining up-to-date and accurate accounting records, establishing clear documentation procedures, and utilizing automation tools to streamline processes.

Our checklist outlines key actions such as verifying balance sheet balances, reviewing income and expense accounts, and reconciling accounts to ensure financial statements are accurate and consistent.

Outsourcing CFO services offer expertise in non-profit accounting, financial strategy, and compliance, providing additional support to internal finance teams and ensuring a thorough and efficient audit process.

A non-profit CPA provides essential financial expertise and guidance, ensuring compliance with accounting standards and facilitating a smooth audit process.