Your organization’s ability to deliver on its mission depends on the strength of its financial systems. Financial capacity assessments are essential projects that go beyond day-to-day financial management. They evaluate your financial infrastructure, identify inefficiencies, and provide actionable strategies to ensure sustainability and growth — all with the support of an Outsourced CFO with nonprofit expertise.

Why Financial Capacity Assessments Are Essential For Your Organization

Governance practices and financial policies are critical for maintaining trust with funders and stakeholders. An outsourced CFO collaborates with your team to assess and enhance practices, offering guidance to minimize risks and align with nonprofit standards. However, the ultimate responsibility for compliance remains with your organization.

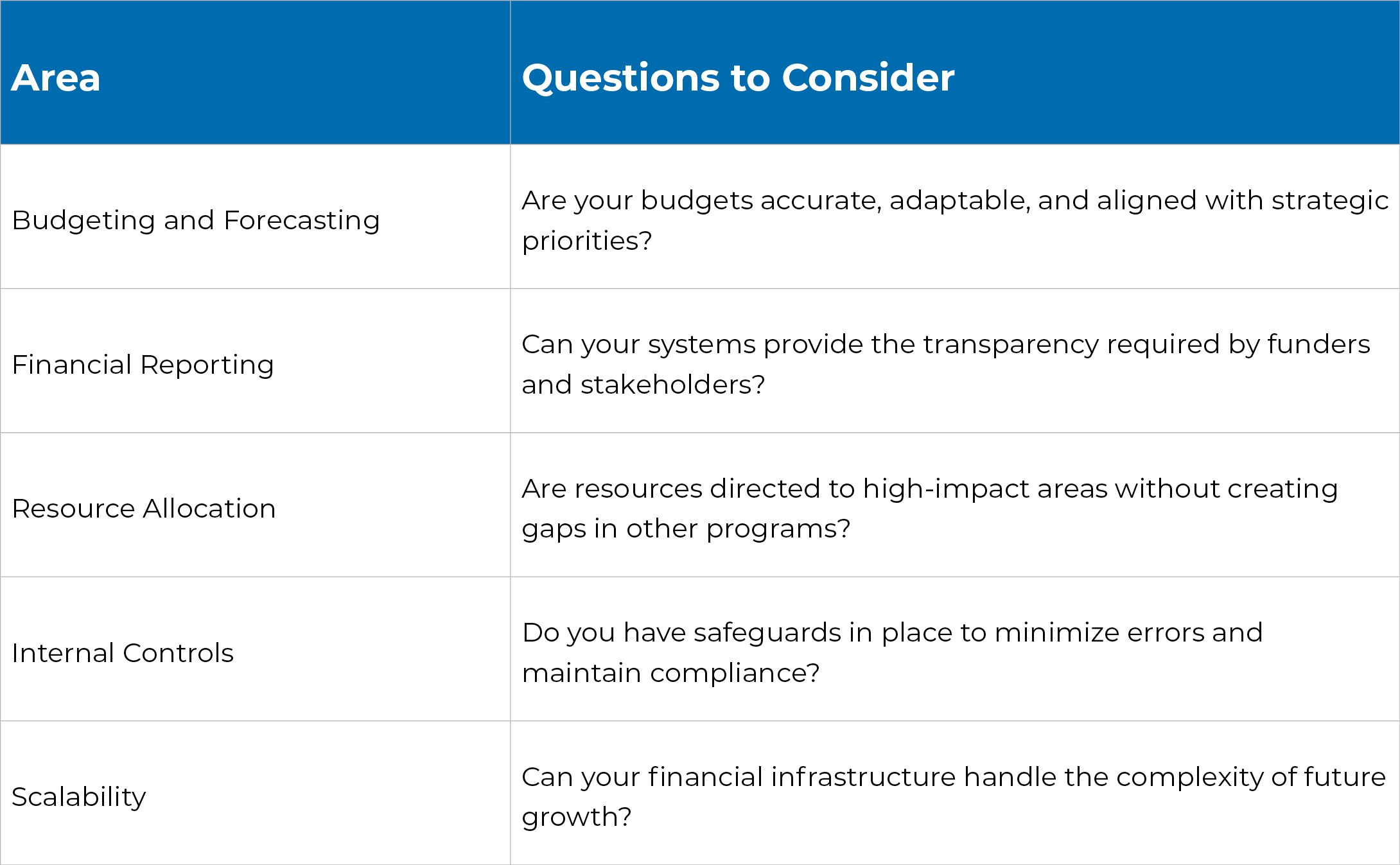

Key Areas Covered in a Financial Capacity Assessment

How An Outsourced CFO Strengthens Financial Capacity

An Outsourced CFO collaborates with your in-house team to execute financial capacity assessments effectively. Their role involves delivering strategic insights and actionable recommendations, ensuring your organization’s financial foundation is well-prepared to support your mission.

Identify Strengths And Gaps In Financial Systems

Your in-house finance team manages the daily financial operations, while an outsourced CFO offers an external perspective to thoroughly analyze your systems and processes. This approach highlights areas for improvement, from internal controls to potential technology upgrades.

Focus Areas:

- Assess the scalability and efficiency of your accounting software.

- Review compliance with donor and regulatory requirements.

- Examine cash flow management strategies for liquidity optimization.

For instance, a non profit conducting a capacity assessment might find that its accounting software lacks the capability to track restricted funds accurately. With the guidance of an Outsourced CFO, the organization could explore options for upgrading its system to improve donor reporting and better align its financial processes with funder expectations.

If you’re assessing your current systems, explore Non Profits Accounting Software: When To Change Or Upgrade for actionable tips.

Strengthen Financial Governance

A financial capacity assessment evaluates whether your governance practices and financial policies align with nonprofit best practices and fund accounting standards. An outsourced CFO provides advisory support to help your team identify areas for improvement and implement strategies that enhance accountability and transparency.

Key Considerations:

- Are your internal controls designed to minimize the risk of mismanagement?

- Are your financial policies up-to-date with fund accounting standards?

- Do your processes meet funder requirements and support organizational goals?

While the responsibility for governance and compliance remains with your organization, an Outsourced CFO offers the expertise and recommendations needed to guide meaningful improvements.

Enhance Financial Reporting For Stakeholder Transparency

Financial reporting is fundamental to earning and maintaining the confidence of funders, stakeholders, and board members. An Outsourced CFO partners with your team to elevate reporting processes, ensuring they are not only accurate and timely but also strategically aligned with organizational priorities.

What You Can Achieve:

- Streamline reporting for better transparency and trust.

- Consolidate data for a comprehensive organizational view while maintaining program-level detail.

- Improve internal reporting to empower informed decision-making.

For specialized reporting needs, outsourced controller services provide immediate expertise to address gaps.

Prepare For Growth And Scalability

Scaling your organization’s impact requires financial systems that can handle greater complexity. An Outsourced CFO helps ensure that your financial infrastructure is equipped to support growth, from managing larger budgets to expanding program offerings.

Key Areas To Evaluate:

- Are your systems capable of handling increased transaction volumes?

- Do your internal controls scale with program expansion?

- Are your teams prepared for the challenges of new funding sources or regional growth?

Why Partner With Array Accounting As Your Outsourced CFO?

As your Outsourced CFO, Array Accounting offers the expertise needed to execute financial capacity assessments and other specialized financial projects. By working alongside your in-house team, we provide targeted solutions that strengthen your organization’s financial foundation without disrupting daily operations.

Expertise For Project-Based Needs

Your finance team is critical for managing day-to-day operations, but certain initiatives benefit from external expertise. Array Accounting brings project-based solutions tailored to your unique needs, acting as your for assessments, strategy, and implementation.

How We Support Your Team:

- Lead the financial capacity assessment process, from analysis to actionable recommendations.

- Identify inefficiencies in reporting, budgeting, and forecasting systems.

- Implement solutions with minimal disruption to your operations.

Delivering Long-Term Financial Insights

Our role goes beyond diagnostics. We provide strategic recommendations and help prioritize improvements that align with your mission and goals.

Key Deliverables:

- Streamlined reporting processes for funders and stakeholders.

- Improved systems for cash flow management and budgeting.

- Clear, actionable steps for enhancing financial sustainability.

For further support in optimizing your financial operations, learn about our Nonprofit Accounting Services and how they can enhance your organization’s long-term resilience.

Flexible Solutions For CFOs and Finance Teams

A financial capacity assessment often reveals areas that need specialized attention, such as liquidity optimization, cost allocation methods, or software upgrades. As your Outsourced CFO, Array Accounting provides the flexibility to address these needs, ensuring your team stays focused on their core responsibilities.

Strengthen Financial Capacity With An Outsourced CFO Partner

Your organization’s success relies on robust financial systems that align with your mission and support long-term growth.

While your in-house finance team focuses on daily operations, a specialized partner like Array Accounting can step in as your Outsourced CFO to handle project-based initiatives like financial capacity assessments. This allows your organization to benefit from targeted expertise without interrupting your team’s workflow.

With expertise in outsourced controller services, fractional CFO services, and specialized non-profit accounting, we help your organization optimize its financial foundation. Whether you’re preparing for growth, improving reporting, or streamlining operations, we deliver actionable insights and results that drive your mission forward.

Ready to strengthen your financial systems? Explore our Nonprofit Accounting Services or contact us to take the next step toward financial resilience.

FAQ

An organizational capacity assessment evaluates the strengths and weaknesses of your nonprofit’s financial and operational systems. This process helps identify areas for improvement, ensuring that your resources are being effectively allocated to support your mission. It focuses on key aspects such as budgeting, forecasting, financial reporting, and internal controls.

If you’re unsure whether your financial reporting processes need improvement, explore our guide on financial reporting process optimization.

Strong financial collaboration between your team and external partners, such as an Outsourced CFO, ensures that financial processes are aligned, transparent, and effective. By fostering collaboration, you can streamline reporting, enhance compliance, and make informed decisions that support your mission.

For actionable tips, explore our Non-Profit Collaboration Checklist to ensure your financial partnerships drive success.

Your organizational capacity assessment should focus on key financial areas such as:

- Accounting processes and internal controls

- Budgeting, forecasting, and reporting systems

- Cash flow management and liquidity

- Resource allocation efficiency

- Scalability of systems for future growth

A fractional CFO consulting partner can help ensure that all these elements are thoroughly evaluated.

If you experience delays in financial reporting, difficulty tracking restricted funds, or inefficiencies in budgeting, these could be signs that your accounting processes need improvement. A fractional CFO can assess your current systems and provide strategic advice on optimizing processes for better accuracy and efficiency.

An organizational capacity assessment tool helps streamline the evaluation process by providing a structured approach to assess your nonprofit’s financial health, systems, and practices. The tool typically covers areas like budget accuracy, reporting transparency, and internal control strength, giving you clear metrics to work with.

It offers nonprofits the flexibility to access expert financial advice and strategic insights on a part-time basis. This is especially helpful for conducting specific projects like financial capacity assessments or process improvements without committing to a full-time CFO. To explore whether fractional CFO services are right for your nonprofit, check out our 10-Point Checklist: Does Your Nonprofit Need Fractional CFO Consulting?.

Improving your accounting processes starts with a detailed review of your current systems. Look for areas of inefficiency or inaccuracies in tracking and reporting. An Outsourced CFO can assess your systems, recommend improvements, and even help implement new tools and software to streamline your accounting operations. Learn more about how great accounting processes can benefit your nonprofit in our blog.

It’s advisable to conduct an organizational capacity assessment annually or whenever you undergo major changes (such as program expansion or new funding sources). Regular assessments help ensure that your financial systems remain efficient and capable of supporting your nonprofit’s growth and mission.